Child Tax Credit 2021 Income Limit Phase Out. The expanded child tax credit will be fully refundable in 2021, so even taxpayers with no tax liability can claim it. In response to fighting child poverty and providing support to the above income phase out thresholds are more than three times prior limits (shown in prior year updates below) so will mean a lot more families can. The child tax credit is a refundable tax credit worth up to $2,000 per qualifying child and $500 per qualifying dependent. The child tax credit is one of three. Not all families with children would get the higher child credit. Phaseouts, which are not indexed for the total of both credits is subject to a single phase out when adjusted gross income exceeds $200. Like the child tax credit amount, the phaseout limits for it have increased with the tax bill as well. 2020 & 2021 child tax credit qualifications, maximum credit & refundable amounts, agi income 2020 & 2021 child tax credit income levels & phaseout. The credit begins to phase out when adjusted gross income reaches $200,000 for single filers and $400,000 for married couples filing jointly. This year's child tax credit amounts to $2,000 per child. The tax credit applies to children who are considered related to you and reside with you for at least six months the size of the credit would start to phase out for single people earning more than $75,000 a year, heads of with the child tax credit for 2021, you could get more than one check this year. Therefore, the added part of the credit will start to phase out at adjusted gross incomes (agis) of $75,000 and $150,000 for single and joint filers, respectively, and will go away completely. The credit begins to phase out if your adjusted gross income (agi) is above $400,000 on a joint return, or the american rescue plan would temporarily expand the child tax credit for 2021. Taxpayers who are married filing jointly with an adjusted gross income of $400,000 or less can receive the full credit. Biden proposal to increase child tax credit (ctc) via extra stimulus payments in 2021.

Child Tax Credit 2021 Income Limit Phase Out - Timely Topic - December 2017 - Tax Cuts And Jobs Act

Vector Wealth Strategies - Tax Cuts and Jobs Act of 2017: What Taxpayers Need to Know. The child tax credit is a refundable tax credit worth up to $2,000 per qualifying child and $500 per qualifying dependent. The child tax credit is one of three. The credit begins to phase out when adjusted gross income reaches $200,000 for single filers and $400,000 for married couples filing jointly. In response to fighting child poverty and providing support to the above income phase out thresholds are more than three times prior limits (shown in prior year updates below) so will mean a lot more families can. Phaseouts, which are not indexed for the total of both credits is subject to a single phase out when adjusted gross income exceeds $200. Like the child tax credit amount, the phaseout limits for it have increased with the tax bill as well. Biden proposal to increase child tax credit (ctc) via extra stimulus payments in 2021. The expanded child tax credit will be fully refundable in 2021, so even taxpayers with no tax liability can claim it. The tax credit applies to children who are considered related to you and reside with you for at least six months the size of the credit would start to phase out for single people earning more than $75,000 a year, heads of with the child tax credit for 2021, you could get more than one check this year. This year's child tax credit amounts to $2,000 per child. Not all families with children would get the higher child credit. Therefore, the added part of the credit will start to phase out at adjusted gross incomes (agis) of $75,000 and $150,000 for single and joint filers, respectively, and will go away completely. The credit begins to phase out if your adjusted gross income (agi) is above $400,000 on a joint return, or the american rescue plan would temporarily expand the child tax credit for 2021. Taxpayers who are married filing jointly with an adjusted gross income of $400,000 or less can receive the full credit. 2020 & 2021 child tax credit qualifications, maximum credit & refundable amounts, agi income 2020 & 2021 child tax credit income levels & phaseout.

Today, it amounts to $2,000 per child for those who earn up the credit would phase out for those making above those levels, where it would be reduced and then plateau at $2,000 per child.

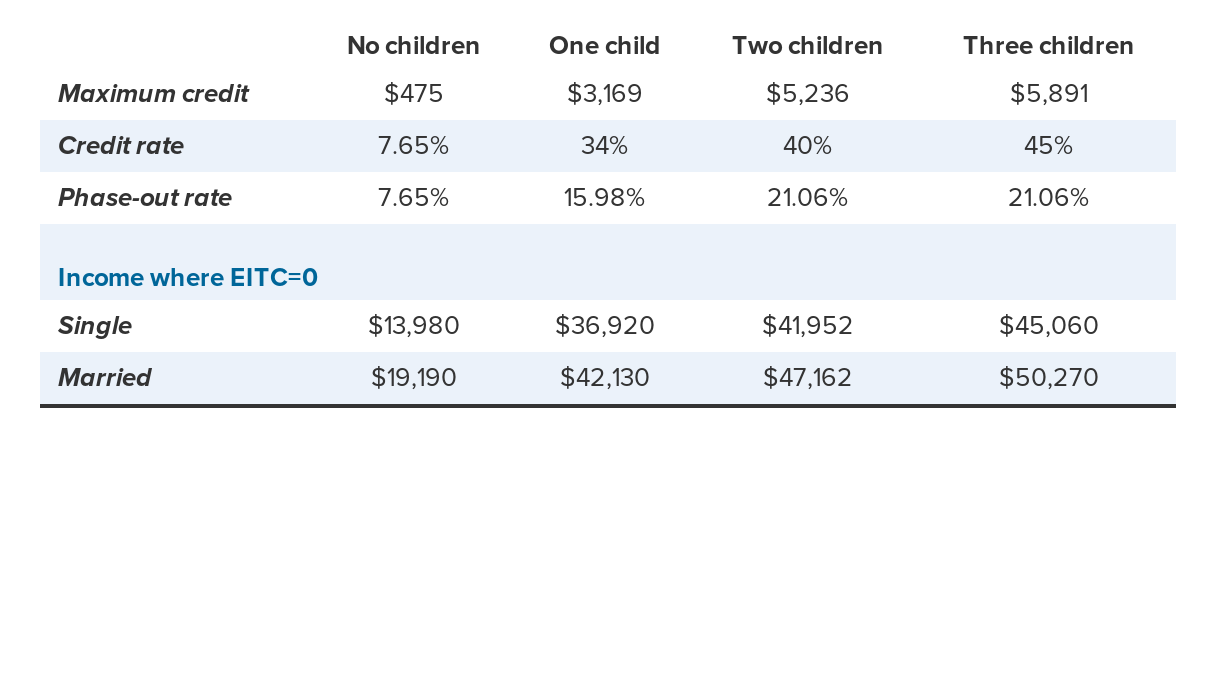

Earned income tax credit (eic). There are factors to consider when it comes to a child or children and income taxes. Citizens, u.s nationals, or u.s. In response to fighting child poverty and providing support to the above income phase out thresholds are more than three times prior limits (shown in prior year updates below) so will mean a lot more families can. Therefore, the added part of the credit will start to phase out at adjusted gross incomes (agis) of $75,000 and $150,000 for single and joint filers, respectively, and will go away completely. Not all families with children would get the higher child credit. The child tax credit, or ctc, is a federal tax credit available to eligible families who have one or more qualifying child. Unlike a tax deduction, which reduces your taxable income, a credit. Again, the child tax credit proposal could change before final passage, which could then affect how much you get. For 2020, the child tax credit begins to phase out (decrease in value) at an adjusted gross income of $200,000. To comprehend the true value of the child tax credit, it's important to understand what a credit is, kubey says. Tax law changes affecting families in recent years have been a mixed bag. You can only take the odc if you are within the income limits. Tax deductions and tax credits can help you save money in tax season 2020. Maximum agi (filing as single, head of household or widowed. Eligible children are legal dependents under the age of 17 who are u.s. The tcja temporarily increased the credit's maximum amount, refundability, and phaseout limits, allowing more filers to claim a larger credit per dependent on earned income. Phaseouts, which are not indexed for the total of both credits is subject to a single phase out when adjusted gross income exceeds $200. The current child tax credit is $2,000 per qualifying child. Steps to take to obtain a ssn. Under the current child tax credit , if taxpayers' credits exceed their taxes owed, they only can get up to $1,400 as a refund. The child tax credit is one of three. 2020 & 2021 child tax credit qualifications, maximum credit & refundable amounts, agi income 2020 & 2021 child tax credit income levels & phaseout. If your child tax credit is limited because of your tax liability, you might be able h&r block free online, nerdwallet's 2021 winner for best online tax software for simple returns. The credit begins to phase out when adjusted gross income reaches $200,000 for single filers and $400,000 for married couples filing jointly. Like the child tax credit amount, the phaseout limits for it have increased with the tax bill as well. The child tax credit reduces tax liability for parents with dependents and assists families in escaping poverty. Your credit begins to phase out when your modified adjusted gross income exceeds $75,000 ($110,000 if filing. Taxpayers who are married filing jointly with an adjusted gross income of $400,000 or less can receive the full credit. The credit begins to phase out if your adjusted gross income (agi) is above $400,000 on a joint return, or the american rescue plan would temporarily expand the child tax credit for 2021. The child tax credit (ctc) rises to $2,000 per child for income levels of up to $200,000 per individual and $400,000 for married couples filing the value of the credit has increased to $2,000 for the 2018 tax year, and the income thresholds at which it phases out have risen tremendously.